With the year’s Q3 report presented, we observed that top iGaming entities had their stocks fall heavily. Although the third quarter is known for its slow pace in the iGaming scene, investors turned their backs on these companies, leaving them with significant losses. This singular circumstance gave room for the query – are iGaming giants seeking their interests rather than pleasing shareholders?

Significant Losses Worldwide for Top Actors in the Casino Industry

Prominent online casino actors in the European market saw their stocks plunge after a somewhat disappointing Q3 report. For context, Betsson Group (STO:BETS-B) and Kindred (STO:KIND-SDB) suffered a significant share value reduction.

However, these entities aren’t alone, as other top-tier gaming companies endured negative dividends worldwide. While our previous reports centred on Macau casinos taking a big hit with Chinese regulations coming into play, we’ve now seen a similar phenomenon spread on a global scale.

Well, the plot thickens as North American online casino stocks have come under extreme losses this year after the reopening of land-based casinos. This scenario directly contrasts 2020, a year that saw them rank among the leading stocks on the financial market.

While there’s speculation that pandemic measures helped online businesses grow, we’ve seen a retracement of the touted “unnatural growth.” From the looks of things, the market is seeking equilibrium.

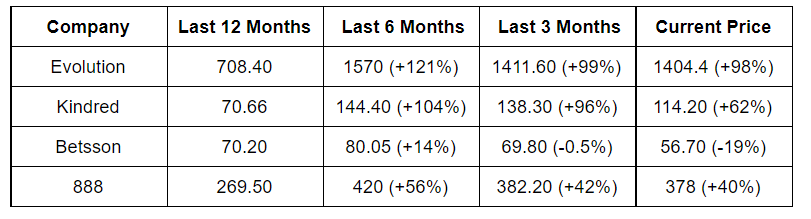

Price Development for iGaming Stocks in the Last 12 Months: Getting Perspective From the Numbers

Deciphering the above chart, you’ll notice that every entity made positive dividends in the last six months. As it stands, the iGaming firm Betsson comes out top in loss margins, with a negative of 19% on their initial value.

Evolution Stocks Plunging

Evolution Gaming (STO:EVO) has seen tremendous growth in recent years, with its share price following a similar path. However, the end of Q3 2021 saw this gaming giant witness a staggering 15% loss.

That said, the reasons for this scenario isn’t far-fetched as they’ve acquired several iGaming companies to boost their portfolio. Notable acquisitions include NetEnt, Big Time Gaming and Red Tiger Gaming.

Due to these buy-ins, they’ve soared in the iGaming scene. On the flip side, it seems like Evolution Gaming is becoming stagnant. Have they eaten more than they could chew? Well, it’s easy to take that line of thought. However, with their reputation growing in the iGaming market, Evolution Gaming must employ innovative strategies to get back on track.

It seems as though Evolution is looking to bounce back to winning ways with sights on several new markets based in Asia and North America. This path seems to be the way to go as Europe is an already conquered territory for the already well-established provider.

Pontus Lindwall’s Reinstatement and Its Seeming Negative on Betsson Stocks

There was disarray in Betsson’s upper echelon when the board announced the reinstatement of CEO Pontus Lindwall. With the negative press associated with this development, the board had to reinstate him.

Although that might not be the primary determinant for Betsson stocks plummeting, uneasiness gives room for insecurity and distrust, making the average investor pull out their funds and seek viable alternatives.

The share price has struggled to stay afloat for the last six months. With the Q3 report returning no favours, stocks fell with reckless abandon.

In an interview following the disenchanting Q3 report, CEO Pontus Lindwall stated that Betsson is considering expanding into markets and making investments to ensure future stability. Betsson was among the numerous companies that lost following gambling regulations in the Netherlands. However, they’ve applied for a new license in the country and are expected to be approved in the second half of 2022.

With some investors being uneasy, Lindwall gave a reassuring speech when giving insight into the future. Betsson seeks investments that promote revenue diversity. Currently, most of it comes from Europe, and that’s something they’d like to change by venturing into the Latin American and Asian markets.

Kindred 15% Revenue Loss: What Does the Future Hold for This Innovative iGaming Entity

Unibet and Kindred saw heavy losses in revenue with the Q3 report release. Compared to the previous quarter, a 15% loss in revenue had shareholders raise concerns as to where the betting company was headed. Like Betsson, Kindred took a significant hit due to gambling regulations in the Netherlands. Due to license approval, they’ll have to wait till 2022 to become fully operational in this market.

That said, another reason for lost revenue was the reduced patronage of their sportsbook.

The Nordics have historically been good for the Kindred Group, but due to issues with the Norwegian Gaming Authority (NGA), they’ve had to focus on diversification and reaching new markets.

So what does the future hold for the Kindred group? For starters, they’re mapping out investment plans to become an actor in the saturated US market. With loads of revenue pumped into this jurisdiction, Kindred hopes to make some profits once they’re up and running.

Despite their losses, there’s a glimmer of hope for Kindred. For instance, being a pioneer for interactive betting will generate a certain degree of success for the group. With innovation being the prerequisite in bringing the iGaming industry forward, Kindred might lead the way with its interactive betting features.

For investors looking to expand their portfolio with an exciting company, Kindred should be considered a “go-to” alternative. Since the company has solid leadership, it seems like they could be positioning themselves for something bigger. From the looks of things, Kindred might be a revered entity in the years to come.

Losses in the Mix for 888: Any Plan to Revamp Things for the Better?

The UK’s favourite 888 Casino saw losses after the Q3 report. From a September high (458), they lost about 20% by the end of October (367.60). While the increments in 888 Holdings revenue makes the drop hard to understand, it’s pertinent to note that they took a hit due to Dutch gambling regulations. Stripping them of their license, 888 Holdings made losses within the confines of £10 million.

That said, 888 Holding is seeking to expand as they’re expected to acquire several parts of William Hill’s European operations. This move will invariably generate positive revenue for 888 in the future. Since falling in mid-October, their share price has seen an upward trend in recent days (378).

888 has established a presence in the US by launching its sportsbook in Colorado. Making profits in the freshly regulated market of Germany is also a goal since their recent launch in the country.

Looking Beyond the Numbers: What Does the Future Hold for iGaming?

The recent drops in stock value and revenue have seen many investors uncertain. However, Q3 traditionally offers a slower pace in the iGaming market might bring some respite. The fourth quarter (current) usually generates the best revenue for iGaming. With positives in the mix, the top iGaming firms can stabilize their businesses before the year ends.

Western European and Nordic markets have seen some stagnation in profits. Resultantly, expansions into unexplored territories have become a must for giants like Evolution and Betsson.

Although last year’s lockdown and pandemic measures resulted in new customers entering the market, this year has seen the reopening of economies. The result? Lost revenue for online businesses.

With the US markets offering profitability, expansion endeavours by some iGaming entities are ongoing. Additionally, Latin America has also seen gambling revenue skyrocket over the past years.

The iGaming industry needs to churn out nifty technology that makes online gambling fun and exciting to keep current customers happy. However, spreading into other regions is of utmost importance for select entities to get revenues and profits to a level previously referred to as unattainable.

Latest articles

Latest Americas Cardroom Promo...

Best Sports Betting Sites in N...

Shazam Casino Review – Shazam ...